Publication

International air demand up in the first two months of 2023

According to data made available by IATA and Eurocontrol, international air demand and more specifically in European airspace showed strong signs of vitality in the first two months of the year.

Year-on-year growth in passenger revenue per kilometre (RPKs) in the sector increased by 67.0% in January, bringing passenger demand levels back up to 84.2% from the pre-pandemic period. Air capacity, measured in available seats per kilometre (ASKs), also grew 35.5% in relation to the same period of the previous year, placing the load factor at 77.7% in January. In this regard, it should be noted that North American airlines increased their supply of seats, in order to exceed the capacity offered in January 2019.

Chart 1 - RPK's, Global Air Passengers

Source: IATA Economics; IATA Monthly Statistics

China's rapid reopening following the end of restrictions associated with Covid-19 has greatly aided annual growth in global domestic RPKs, reaching 32.7% in January, which represented 97.4% of pre-pandemic levels. International passenger traffic also maintained its sustained and steady growth over the past year to reach 77.0% of January 2019 levels. The dynamic nature of travel restrictions in China was reflected in the huge volatility in trends relating to domestic and passenger traffic since 2020. The latest development in Chinese health policies has responded to the strong willingness to travel demonstrated by Chinese passengers.

Although the difficult international economic climate does not seem to be having a direct impact on travel demand, which has been strongly suppressed for more than two years, and all world regions show increases in demand and air movements in early 2023.

The US domestic market continued its strong recovery in January, with domestic RPKs up 26.8% YoY and coming in 3.1% above levels reached in January 2019. In Brazil, traffic grew 3.0% YoY, bringing January passenger levels closer to just 3.2% below pre-pandemic levels. These developments are consistent with airline performance improvements in the Americas, regions where domestic RPK's in January increased 3.4% YoY in Latin America and 2.7% YoY in North America, above pre-pandemic levels.

In Europe, too, domestic passenger traffic continued to rise above pre-pandemic levels, with domestic traffic carried by European airlines up 15.4% compared to January 2019 and 19.2% compared to January 2022 levels.

Chart 2 - Domestic RPK growth, by region, change vs 2019

Source: IATA Economics; IATA Monthly Statistics

Chart 3 - International RPK growth, by region, variation compared to 2019

Source: IATA Economics; IATA Monthly Statistics

For all national, international and intercontinental flights taken together, but originating or arriving at European airports, the picture is one of a marked recovery in air movements compared to before the pandemic. Eurocontrol estimates that air movements are about 15% lower than in the same weeks of 2019. In the period analysed, Portugal was always positioned as the 10th country with the highest number of air movements and Humberto Delgado Airport was in the Top-10 busiest in Europe for a fortnight.

|

Indicator Week |

Variation vs. 2019 |

Portugal's position |

TAP's position |

Lisbon Airport Position |

|

5-11 January |

-14% |

10.º (973) |

15.ª (318) |

9.º |

|

19-25 January |

-16% |

10.º (862) |

15.ª (304) |

Out of Top-10 |

|

2-8 February |

-14% |

10.º (901) |

16.ª (302) |

Out of Top-10 |

|

16-22 February |

-13% |

10.º (1011) |

17.ª (301) |

10.º |

Source: Eurocontrol

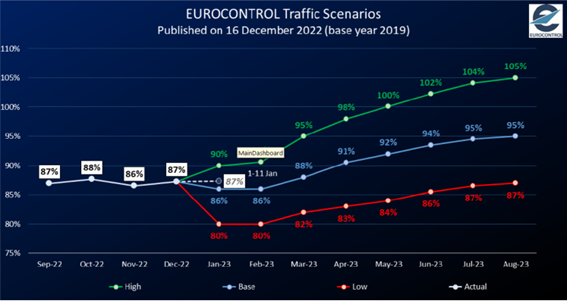

If the more optimistic scenario outlined by Eurocontrol comes true, the number of air movements in European space could, from May, equal or even exceed the figures achieved in the corresponding periods of 2019.

Source: Eurocontrol

Source: Eurocontrol

No publications to show