Lisbon, and Portugal in general, are affirmed trends in the European residential market. Mild climate, favorable geographical position, specialised talent, high security index, rich history and culture, quality of life and affordable prices, are some of the many factors that combined differentiate Portugal in the global market. All these factors are evidenced in the latest Savills study, which classified the 15 main residential markets preferred by digital nomads, considering factors such as internet speed, quality of life, climate, air transport connectivity and rental prices, and elected Lisbon as the preferred choice ahead of Miami and Dubai.

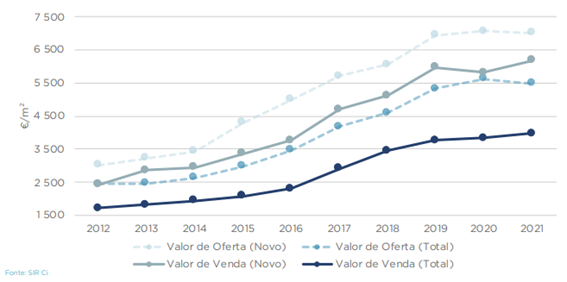

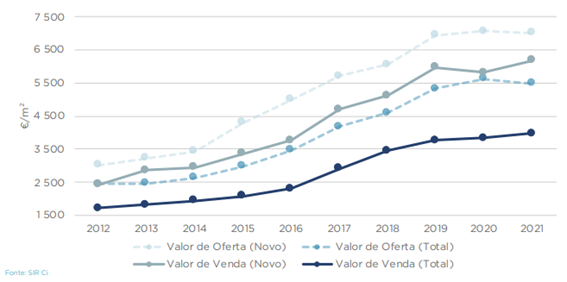

Due to this trend, prices are expected to continue to rise in Lisbon, as demand will continue to outperform supply (Graph 1). In Lisbon, there is a long way to go to develop the residential offer available in the market, not only in quantity, but also in typology. There are rapidly developing neighbourhoods and areas such as Marvila or Beato, but there is still a lot of rehabilitation to be done in the most central areas.

Graph 1 — Price evolution in the sale of apartments and Lisbon since 2012 (EUR/m²)

Extracted from: Cushman & Wakefield, Marketbeat Portugal (March, 2022)

According to the CRS/Confidencial Imobiliário, the average sales figures in Lisbon last year recorded annual growths, namely 6 % for EUR 6.100/m² in new apartments and 4 % for EUR 3,870/m² in total apartments (new and used). Among the latter, the highest figures continue to occur in the Historic Centre (EUR 5.270/m²) and in the traditional area (which recorded the largest increase of 10 % to EUR 4,820/m²). Due to the influence of the new residential projects in Marvila, the peripheral area recorded the second largest increase (+ 7 %), although it still continues to record the lowest unit value (EUR 2,800/m²).

With increasing levels of activity, the Portuguese residential market remains a magnet attracting international buyers, who weighed 40 % of sales by the end of the 1st quarter of 2022. In the meantime, and even with increasing investment in the launch of new products, demand continues to far exceed the available supply, in a scenario that is expected to continue to sustain current price levels over the nearest time.

The relief of some of the restrictions on the movement of tourists that had been imposed in the context of the fight against the pandemic at the beginning of last year contributed to a strong recovery in tourism activity, with the number of overnight stays and visitors in Portugal quadrupling in the first two months of 2022 compared to 2021, while in hotels the differential of the main performance indicators compared to that observed in pre-pandemics is becoming less and less significant, with even exceptions where new records are already being exceeded.

In the same sense, the Local Accommodation activity started a growth trajectory in the second half of 2021, despite the fall in supply resulting from the targeting of several properties to long-term rental and its indicators account for only half of the values recorded in 2019.

The international highlight that Lisbon has had in recent years is undeniable, with many of the recognition awards that the city has won, namely:

Best City Breal Destination in the World, by World Travel Awards 2020;

A Must-see City for Young Workers in Europe Center for the Future of Work, by Cognizant;

Lisbon 7th Place in the Ranking of the 10 Cities in the World With Best Quality of Life, by Monocle Magazine, 2021;

Most Desirable Short Distance City, by Wanderlust Travel Awards, 2021;

Europe’s Most Culturally Dynamic City, by European Commission, 2019;

City of the Year, by Design Awards 2017, Wallpaper Magazine.

Reborn after a long and profound process of urban regeneration, the city of Lisbon underwent sociodemographic and economic changes that completely changed its dynamics, transforming it into a modern and innovative urban metropolis. The process of urban regeneration, responsible for changing the use of office buildings and residential buildings for tourist purposes, along with a very significant increase of new residential projects aimed at the market of higher and higher quality segments, has been positioned as a very attractive investment possibility.

As the city increases its notoriety and visibility in the global context, being already home to many international companies and international events, it is also becoming an attraction for new nationalities of buyers and residents who play an active role in changing the city. The city became increasingly attractive to foreign buyers, driven first by tourism and then by fiscal mechanisms such as the Golden Visa and the Non-Habitual Resident.

Not only were the new health and safety concerns that the COVID-19 pandemic brought into everyday life. Portugal now knows new inhabitants brought by the pandemic and the more widespread practice of new hybrid models of work. Motivated by the greater flexibility of remote work, digital nomads, freelancers and expatriate professionals find in Portugal a safe haven to live, helping to boost and shape the Portuguese residential market. In the last ten years, the number of foreigners residing in Portugal has increased by 40 %, to more than half a million people and with a weight of 5.4 % of the total Portuguese population.

In the last two years, Lisbon has become a destination for those looking for the hustle and bustle of a typical European capital, but offering a balanced combination of business, culture and leisure. A new social dynamism took over Lisbon, with a mixture of new nationalities that bring to life areas and formerly forgotten neighbourhoods of the city, which are now the target of new modern and quality residential real estate projects, complemented by the support of local commerce.

Lisbon Smart City

The city currently offers a range of sustainable means of mobility that allow those who enter its boundaries to travel easily. On foot, by bicycle, electric scooter, public transport or shared vehicles, the range of possibilities is growing, within a global framework of sustainable development.

A smart city aims to attract more residents, increase the quality of its residential park, attract investors, offer new residential models aligned with demographic trends, culminating in an increase in the quality of life of its inhabitants through the application of energy efficiency, mobility and social cohesion measures. Lisbon, together with London and Milan, was elected to the European Union as one of the Smart Cities. Lisbon has been recognised for its ability to become a more competitive, innovative, sustainable and creative city.

Lisbon was a European Green Capital in 2020, being an example of a commitment to promoting sustainable and environmentally responsible mobility measures. In 2030, the city aims to reduce private car use by 28 %, giving increasing importance to public, pedestrian and cycling transport.

More recently, the pandemic has given a new impetus to the fixation of foreigners in Portugal. The increasing possibility of remote work and digitalisation, combined with proximity to most European capitals, make Portugal strategically well positioned for home to a profession that does not require regular attendance to the office. Although the resident population in Portugal has decreased in the last 10 years, the foreign resident population has increased by 52 %, according to INE data.

The national market, with Lisbon highlighted, meets all the conditions to gain robustness throughout the year, as there is a real demand for offices and housing, and with regard to investment, Portugal remains very well positioned to compete for the high liquidity available in the international landscape. Our market has not lost attractiveness to foreign demand, whether for purchase of final product or for purchase as investment.

Learn more:

Savills | JLL | Cushman&Wakefield